QuickBook Tips You Need to Know

All through July, I’ve written and talked about QuickBooks, especially for those of you who manage your own books. DIY Bookkeeping doesn’t have to be tricky, but there is a learning curve.

Let’s review my tips from my Wednesdays with Wendy segments on Facebook! Following these tips will help you optimize your business throughout the entire year.

Doing your own bookkeeping in QuickBooks?

Throughout the month of June, I've been sharing information for those of you who do your own bookkeeping, especially those who use QuickBooks. I get a lot of questions about QuickBooks and how to best manage it on your own!

Before you get too discouraged, remember that none of us is born knowing this information. Managing your own bookkeeping has a steep learning curve, and it's a special skill you must learn, even if we're looking at basic reports.

Let’s take a look at two of the most common problems I see when people are managing their own QuickBooks.

Avoiding Burnout as an Entrepreneur

A few years ago, I wrote about the emotional side of being an entrepreneur and focused mostly on overcoming impostor syndrome.

Throughout May, which is Mental Health Awareness Month, I’ve focused on different aspects of managing mental health as an entrepreneur in my Wednesdays with Wendy Facebook Lives. I also mentioned burnout in my latest newsletter.

Dealing with and even preventing burnout is so important not only for our mental health, but for the health of our families and businesses. That’s why I’m using today’s blog space to talk about it more in-depth.

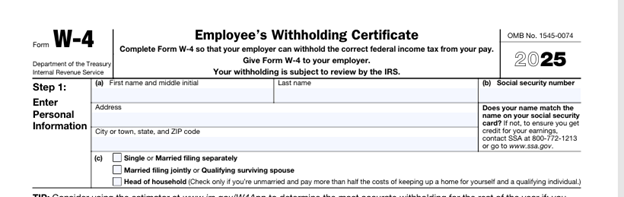

Guide to Filling Out the W4

Were you happy with how your tax return turned out this year? If you weren’t, read on to find out how to adjust your income tax withholding so that next year can be better!

First, you need to know that there are two ways to pay your federal income tax.

Estimated tax payments

Withholding via payroll that shows up on your W2 at year-end

Estimated tax payments are a topic for another time, but today, I want to talk about how to complete the W4 to your best advantage while still fulfilling your financial obligations to the IRS.

QuickBooks Online for Tax Prep

Expenses that are Not Tax Deductible

I’ve mentioned many times how to know which business expenses are deductible. You can refer to this IRS guide. You can also remember these two words: ordinary and necessary. For an expense to be tax deductible, it must be an expense incurred in the ordinary course of business and necessary to achieve your business goal.

This month, I wanted to mention several expenses that many think are tax deductible but aren’t.

Should You File Your Own Taxes?

I get a lot of questions about whether or not you should complete and file your own taxes, especially this time of year. I could talk about this for hours, but I wanted to give you a quick, updated guide to answering this question for yourself.

Bookkeeping seems so easy. Why can’t I do it myself?

Back in 2021, I had the experience of a lifetime! My husband and I flew on a private jet to a beach house in the Caribbean. It was through his (now former) job, so that was the first, only, and probably last time I would ever fly in a private plane. While we were flying, my husband got to sit in the copilot seat and watch the pilot fly the plane. He told me that, other than takeoff and landing, it was actually easy. Once in the air, they just have to hold the controls and keep it straight. Takeoff, landing, and when you hit turbulence are when you’re going to wish you had someone in your corner who knows how to manage the controls.

The same is true for managing your business's financial records.

An update on the BOI

Last week, I went live on Facebook to share an important topic. In the last couple of months, I’ve talked a lot about the Corporate Transparency Act and the Business Ownership Interest (BOI) reporting deadline. The deadline was Jan. 1, 2025.

Until now.

The tale of two business myths

I recently saw a post in a Facebook group I’m in about starting a business and the author said, “We’re not yet generating enough revenue to form an LLC.”

Last year, while speaking with someone who had just started their business, they told me they “didn’t make enough to report it on my taxes.” Aye yi yi!

So, this month, let’s discuss how to know if you have a business, when to report it on your taxes, and why this can be a tricky subject.

Your Year-end Checklist for 2024

It may not even be Halloween yet, but it’s already time to start thinking about your year-end financials and tax preparations for 2024. The better prepared you are, the easier it will be for your bookkeeper and tax preparer to do their jobs.

Here is the general checklist I give clients, whether they are self-employed or an S-Corp.

Selling. Sales. Marketing.

Ugh. I have never been a salesperson. When I was in the first grade, my elementary school sent us door to door to sell jars of spices. The salesperson for the fundraising company had made a presentation to the entire school. We were to tell people we were selling “cry-proof onions” (dried onions) and other such cheeky claims. I thought it was stupid. My little brother, on the other hand, loved it! We’d set out together, and at each house, he’d trot out a cute little soliloquy that caused the people to smile and laugh and say, “Sure! I’ll take two! Oh, and one from your sister,” as I stood off to the side with a scowl on my face that would cause the devil himself to recoil in horror.

Yeah, selling and me never really got along. Fast forward to 2016, when I started my own business. Obviously, now I was going to have to sell my services. How was I going to do that?

Here are three philosophies on selling that helped me turn the tide and embrace it!

How to turn your sales around and win more customers

I’m no stranger to discussing numbers on the blog, but they usually involve the expenses side of a business. This month, I want to discuss the other side of the equation—the revenue side.

People start a business for many different reasons. Those reasons often involve serving an underserved population or providing products that people need. The entrepreneur’s reasons are usually bigger than just making a profit.

However, if your business continually spends more money than it takes in, it won’t be a business for long. In order to be successful in business, you have to provide a product or service that people want.

Tax estimates from your tax preparer: What they are and what to do about them

Once a tax return is finished, the software that was used to prepare the return will look at the amount of income you had, the amount of tax you paid, and whether you owed or got a refund. Then, it will make a recommendation based on how last year went. If you owed taxes in April, or if you didn’t have enough tax withheld through your paycheck, the software will print out “estimates.” These are amounts of tax that you need to pay in each quarter in order to not owe taxes next April. If you make these estimated payments on time, and if your financial situation is roughly the same as last year’s, you will probably not owe additional taxes next April.

That’s why they are called “estimates.”

What happens when a business fails?

I recently came across an interesting Facebook post that talks about a problem that might be more common than you think. A person was looking for an attorney and asking for advice on commercial leases. She and her husband owned a business, but the business failed. However, they were still under the lease contract for their space. The landlord is now threatening to sue them for unpaid rent.

Depreciation made easy!

Picture this: It’s December. The weather has turned cold, and the holidays are all abuzz. You’re in the middle of checking things off your Christmas list. Your family is making plans for how they're going to spend the last few weeks of the year, and you are looking forward to some well-deserved time off. As a small business owner, you sit down and run your Profit & Loss report. Looking back over the past 11 months, you marvel at the huge profit your wildly successful business has made.

But wait! You think. That huge profit is going to turn into a huge tax bill next April! What should I do? Is there any way to reduce that potential tax bill?

Checklist for your year-end financials

As we approach the end of 2023 and look forward to 2024, I know many of us will be celebrating with family and friends. If you’re a small business owner or solo entrepreneur who does your own bookkeeping, you will also be busy closing out your books for one year and preparing for the next!

I thought I’d make the task easier by creating this checklist of year-end items you need to make sure to complete to get ready for the new year!

To close out this year, here is what you need to do:

What does your friendly neighborhood bookkeeper do for you?

When people ask you what you do for a living, what do you tell them? Do you share just your job title or take it a step further and explain how what you do makes a difference for your clients?

I wanted to take this opportunity as we enter into the last quarter of the year to reintroduce myself and show you how I can help. Today I want to answer the question, "What does your business do and why should they care?"

My whole reason for starting this business was to help other small business owners keep better track of their finances. When I did tax returns in public accounting, I saw so many small business owners bringing in boxes of receipts, or worse, nothing at all, and wanting to have their taxes done. They were overwhelmed, exhausted, and completely unaware of how their business was actually doing. My heart went out to these hardworking folks.

Even my logo, an open book that resembles a bird in flight, (designed by a fellow small business owner and client, Casey Weatherford of Kind Creative Co.) represents the freedom you experience when your bookkeeping is up to date and accurate.

My primary services are:

Bookkeeping for startups, small businesses, and independent contractors,

Payroll for all three client types, and

QuickBooks installation and clean-up.

I do these so that you can

Save time – I do all three of these services to take work off your plate, which allows you time to run your business and spend more time with your family.

Breath easier – finances are tough no matter what type of business you have and having a professional accountant helps you know the work is not only getting done, but getting completed accurately.

Run your business – I touched on this briefly already, but being able to outsource an often tedious and difficult task to a fellow small business owner allows you to do what you do best, which is operate your business and work with your customers.

Trust your results – Payroll, payroll and business taxes, bookkeeping, and all the other financial aspects of running a business offers plenty of opportunities to make mistakes. With a professional doing the work for you, you can trust your results and know that you are going to be in compliance with the IRS, the state, and your stakeholders.

Are you ready to start fresh this month and go into 2024 with a solid plan? I’d love to help you with your bookkeeping, whether you need help cleaning it up or starting fresh. Give me a call!

Payroll - What it really is

Beware the asterisk (on financial apps)

Have you ever noticed how sometimes the best examples to share in your business come from your own personal experience? I had such an experience recently when my daughter (with my blessing), used an online tax program to complete her taxes. In this example, she used Tax Act, but this warning is for any kind of financial application, especially one that you might be using to complete your taxes.